Forex Leverage For Beginners When first in demo use whatever you want somewhere around + so you can get your VOT in. Once you settle down a bit and get more comfortable dial it down a bit and look at things as risk %. It will simplify your leverage and margin blogger.comted Reading Time: 6 mins As a bigginer, your problem should not be leverage. Just the same way leverage affect bigginer traders so does it affect pro traders when misused. I mean, since leverage is a double edged sword, for that reason a sword does not know if you are an What is the best leverage level for a beginner? If you are new to Forex, the ideal start would be to use leverage and 10, USD balance. So, the best leverage for a beginner is definitely not higher than the ratio from 1 to Start trading with a trustworthy brokerEstimated Reading Time: 7 mins

What is Leverage in Forex Trading? A Beginners Guide ()

Leverage is a kind of interest-free loan provided by a broker. You can use leverage to increase the size of your position, and so, increase the returns. Or, you can use leverage to reduce margin the collateral demanded by the broker for the position opened, what is the best leverage for forex trading beginners.

Read on and you will learn what is leverage and how it works. You will also learn how to calculate and find out the most optimal leverage. I will cover all the pros and cons of leverage trading and give real examples of leverage forex trading. Imagine that you buy apples in the wholesale market in a big city and sell them in a local market in a small town.

It is clear that have a certain extra charge for providing the service of moving apples from the wholesale market to the small town. And the more apples you can buy in the wholesale market, the more you will earn on the markup provided that all the apples are sold out. But you have a limited amount of cash. You understand that you can sell 5 times more apples in the local market, and you go to a bank to take a loan, what is the best leverage for forex trading beginners.

Forex leverage explained in simple terms is a kind of the bank loan provided by the broker to the forex trader. If you have a relatively small deposit and use the leverage, you can buy several times more currency or stocks, and so, make several times more profit.

But there is a significant difference between a bank loan and the forex leveraging. A forex trader can use leverage any time for free, the broker provides the loan with no interest charged on the amount of debt. An option that allows a trader to enter trades with a volume several times larger than the actual amount of money on the trading deposit.

An instrument of margin trading, which is the funds you borrow to increase the position volume, and so, to increase your profit, in case your equity is not enough. The maximum Forex leverage is specified in trading conditions for each type of trading account. For example, the maximum leverage for one account is ; for another account, it will be A leverage means that the trader trades only with own funds.

A leverage means that the trader can open a position of times more volume than the funds he or she owns. There is no upper limit, in theory, that is why you can come across the Forex leverage of For example, a operating leverage, in this case, means that to open a position of units of the basic currency, the trader will need times less money, which is 10 units. This amount of money is called margin, which is the sum blocked by the broker until the opened position is closed.

Margin is the money needed as collateral that you should have on your account to be able to trade Forex using leverage. Assets total. That is the amount that will be on the account if the positions are closed right away. While positions are open, the amount is floating. Assets used margin, collateral.

These are the funds the broker blocks when you enter a trade. This the amount of your deposit that directly relates to the leverage. Available for operations funds is the amount of free money that the trader can use. It is calculated as the difference between equity and margin. In this example, I entered a trade a minimum lot of 0.

It means that I cannot enter another, I just do not have enough money. I open the same demo account, but with leverage of and enter three trades with a volume of 0. With leverage ofI need 10 times less money to enter a similar trade with the same effect. So, I can enter 10 trades with a volume of 0. Or I can enter one trade, but with a volume of 0. A short summary.

Margin is the amount of money set aside by the broker when the trader enters a trade. It can be presented as a table:. You can trade without any leverage at all. For example:. Take the Forex leverage and enter a trade times bigger, the trade volume of which is 1 lot. However, the risk management rules say you should not enter a trade for the entire amount of your deposit, but this is just an example, to demonstrate how leverage works in Forex trading.

For example, you can enter trades on other assets and thus diversify the risks. You will better understand what Forex leverage is if you open a few demo accounts with different deposits, different leverages, what is the best leverage for forex trading beginners, and enter a few different trades.

Click on the OPEN ACCOUNT button, choose the leverage, and, after creating the account, set it as the main account. Therefore, you will open both a real and a demo account. To switch from one account to another, go to the Metatrader tab again and turn the required account into the main one. The demo account provides a leverage range from 1: 1 to On real trading accounts Classic and ECN a leverage range is also from to How to check your account leverage in the MT4 platform?

Such an option is provided in the trader profile, where you can also open an MT4 account and attach it to the terminal having a login and a password. You can see the leverage for each account in your profile. You can also alter the leverage entering the Metatrader menu on the right. Let us see how Forex leverage works on the example of a real situation from the LiteForex trading platform. According to the trading conditions, the minimum trade volume is 0. According to the trading conditions, the minimum transaction volume is 0.

Since 1 lot isbase currency units, the trade volume of 0. That is, a trading volume of 0. But it what is the best leverage for forex trading beginners yet not what is the best leverage for forex trading beginners. And you cannot open the position. When you use the leverage of it is quite a safe leverage for a beginner trader in terms of risk managementyou will be able to enter a trade with a volume of 0. Leverage is an interest-free loan.

To boost your deposit amount and enter trades with a larger volume, you can take a loan in a bank, but you will have to pay interest. Forex brokers do not charge interest for providing you with leverage. You can increase your gains using leverage.

If you increase your trade volume by 10 times using leverage, you will increase your profits also ten times I wrote this before. With the same trade volumes for the same asset, the deposit without leverage will be stopped out sooner than the trading deposit with the leverage. Higher risks associated with the boost in the total volume of open trades.

An increase in the volume of positions also increases the value of a point. Therefore, your potential losses are also amplified. High leverage implies high potential profit as well as high potential losses. This problem stems from the previous point. If the position volume is 0.

In the first case, the deposit will be stopped-out much faster. Psychological trap. When you have free funds spared from the margin requirement with the help of leverage. It can encourage you to boost your position volume adding up to a losing trade if you want to win back your losses. It can also result in unjustified confidence in potential profit.

All the cons of leverage above are the drawbacks only when a trader what is the best leverage for forex trading beginners about the rules of risk management and increases the position volume being ruled by emotions. So, now I believe you understand the general meaning of margin and leverage. Let me summarize briefly:. The above concepts are needed to develop the risk management system and calculate the acceptable level of risk. The above formula is relevant only for currency CFDs traded in Forex.

For other trading instruments, the calculation formula is different. Likewise, the concept of leverage in the what is the best leverage for forex trading beginners exchange, for example, is different from the definition of the Forex leverage as the borrowed funds provided by the broker.

An example. That is a hundredth of the amount of money that a trader will what is the best leverage for forex trading beginners to buy euros 0. Since the collateral is calculated in the first currency for this currency pair, in this case, it will be calculated in USD. But the collateral here is also calculated in the currency that is in the first place in the ratio.

There is a significant difference in how the leverage is applied to the exchange market, which is authorised and regulated, and over-the-counter market.

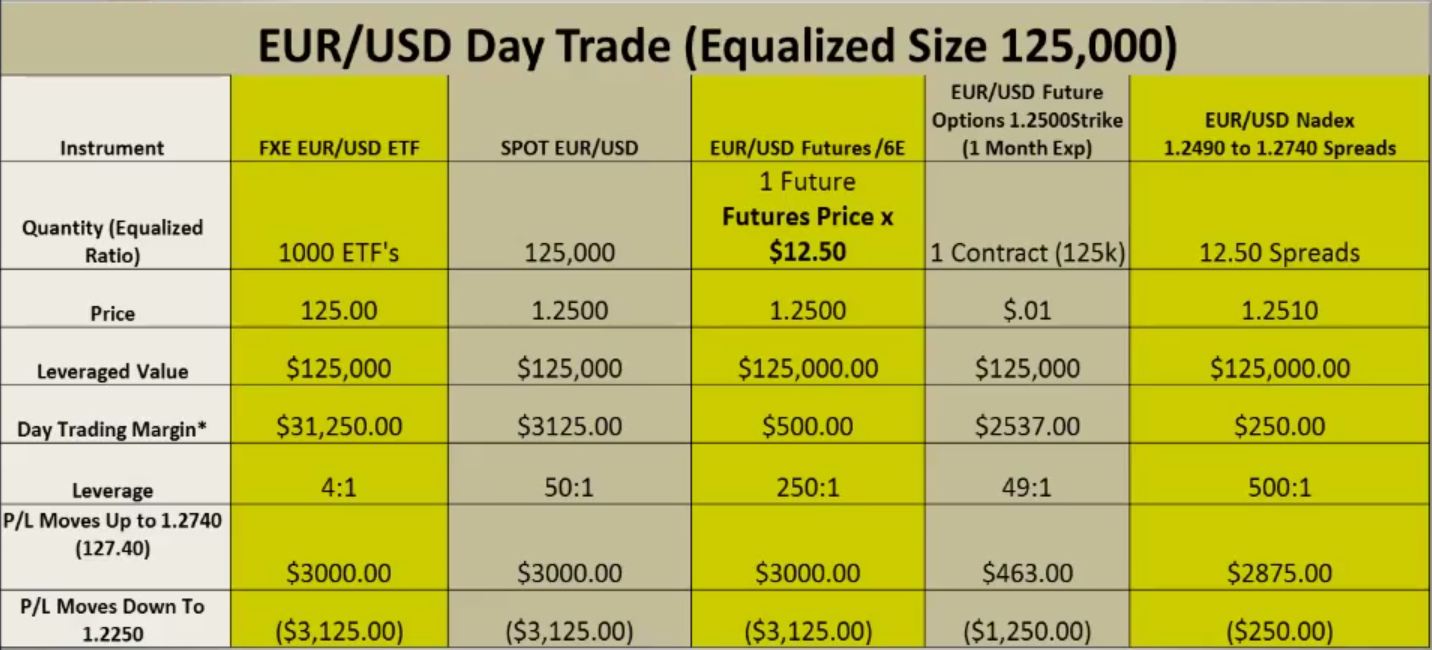

ETF is an index fund whose shares are traded on an exchange. It is based on a structured portfolio of assets, often having fixed costs.

Buying shares of an ETF fund, what is the best leverage for forex trading beginners, a trader actually invests in a consolidated investment portfolio, which can have a diversified structure or consist of instruments of a certain segment. A leveraged ETF allows you to increase the profitability of the shares by the leverage size.

Such ETFs are also referred to as margin trading ones.

What is Leverage \u0026 Best Leverage in Forex Trading?

, time: 8:17What Leverage Should I Use Forex? (Best Leverage Advice) – Stay At Home Trader

Forex Leverage For Beginners When first in demo use whatever you want somewhere around + so you can get your VOT in. Once you settle down a bit and get more comfortable dial it down a bit and look at things as risk %. It will simplify your leverage and margin blogger.comted Reading Time: 6 mins Aug 19, · Best Leverage for $ and up to $ Depositing $ or more to your trading account, even if you are a beginner, is more realistic. A small account relies on high leverage and risking a high percentage of the account balance. The best leverage for $ also depends on how many positions you intend to hold blogger.comted Reading Time: 4 mins Jan 11, · Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders. Leverage in the forex markets can

No comments:

Post a Comment