6/8/ · In order to use the Forex strength meter for trading, it’s preferred to use it with longer timeframes. This includes a couple of weeks or months timeframes. Only then will the strength of the currency be accurate. Remember, there is always some kind of news that could sow panic in the market, thus causing a major, but temporary disruption 10/21/ · 3 Things Currency traders need to do now: 1. Leave a Comment letting us know how you can use currency strength for trading success. 2. Make sure to access the free tool and bookmark the link so you can use it all the time. 3. Consider Downloading our POWER STRATEGY REPORT and Let us know what you think of it! Thank you for reading!Estimated Reading Time: 7 mins Navigate to Expert Advisors and choose currency strength meter from the set of tools displayed. To use the indicator, you only have to drag it to a previously opened currency chart. Set your parameters using the window that pops up on your screen. Then click on the OK button to view the blogger.comted Reading Time: 9 mins

How to Trade Using a Forex Currency Strength Meter

One of those facets of the Forex FX market that distinguishes it in different financial markets would be the idea of money pairs, how to trade forex using currency strength. Whenever you choose an FX position, you obtain contact with two distinct currencies. This creates many fascinating chances, like the skill to harness on your perspective of 2 markets simultaneously.

But It may be quite sophisticated to evaluate the operation of a money in isolation. Or since the USD is acting badly? This Forex meter exhibits which monies are strong and are feeble at any given time, representing motion in the shape of a matrix. There are a number of difficulties with badly publicized currency strength meters.

With outdated currency strength meters, traders might, but not necessarily, experience:. Some apply smoothing filters, like moving averages, how to trade forex using currency strength, while some apply other filters e, how to trade forex using currency strength.

RSI and MACD. This is just a complex algorithm of indicators that might make you enter false trades and potentially enter a losing streak. The real strength of currency trading comes from correlation.

If the Correlation Matrix has been coded properly, using the latest technologies, it is unlikely to cause any of the aforementioned issues.

Over the years, the Forex strength meter has naturally evolved into a correlation matrix that could also be more complex and accurate. Forex Correlation, how to trade forex using currency strength, like other correlations, is a term designated to signal correlation between two pairs. When two sets of data are strongly linked together, we say they have a high correlation. When pairs move in the same direction, they have a positive correlation, and when they move in the opposite direction, we observe that they have a negative correlation.

A perfect correlation occurs when pairs move in the same direction, which is extremely rare. We say that correlation is high when pairs move in almost the same direction. Opening multiple positions with pairs that are highly correlated is not advisable, as it gives rise to more exposure.

Moreover, having higher exposure to a particular currency can be harmful, should the analysis go wrong. For example, by going long on AUDCHF, AUDJPY, and EURJPY, a trader gives rise to double exposure if they are highly correlated. Knowing the correlation levels between different currency pairs, a trader can get an idea of how they are connected to each other, and may consequently avoid double exposure to a weak currency.

If the correlation strength between different pairs is known in advance, a trader can avoid unnecessary hedging. The reason is that when you win on one trade, you are more likely to lose on another trade, whereas the volatility makes it uncertain as to whether or not the gains will surpass the losses or not. Correlation between different currency pairs can also how to trade forex using currency strength the amount of trade strategy risk.

What might also happen is that one of the pairs indicates a strong movement, while the other is just ranging, which signals traders to avoid entering trades with correlated pairs in the opposite direction. In the example above, positively correlated pairs have shown positive correlation between them, therefore, how to trade forex using currency strength, they move in a similar direction.

Correlations are also divided into four groups in accordance with their strength. For easy viewing, all correlations in the table above are coloured to show their strength, as is noted below:. MT4 is an extremely widespread FX trading platform. One of its advantages is the ability to download and use custom indicators, together with, Expert Advisors EAs.

The MT4 platform comes with a useful selection of popular indicators built into the client terminal. You can also download independently written custom indicators. As MT4 is an open platform, and has such a wide community of users, indicator innovations move fast. There are thousands of custom indicators available for analysing the Forex market using different algorithms.

You can search for custom indicators from within the platform. Some charge money for the full version, but some are entirely free to download, such as MT4SE. Whenever you consider paying for a trading aid, remember that any reputable provider will offer a free trial version, and you can even program an algorithm yourself. MT4SE is an extended version of the client terminal. It includes many features; not just the currency strength meter, but also a live trading simulator to backtest strategies.

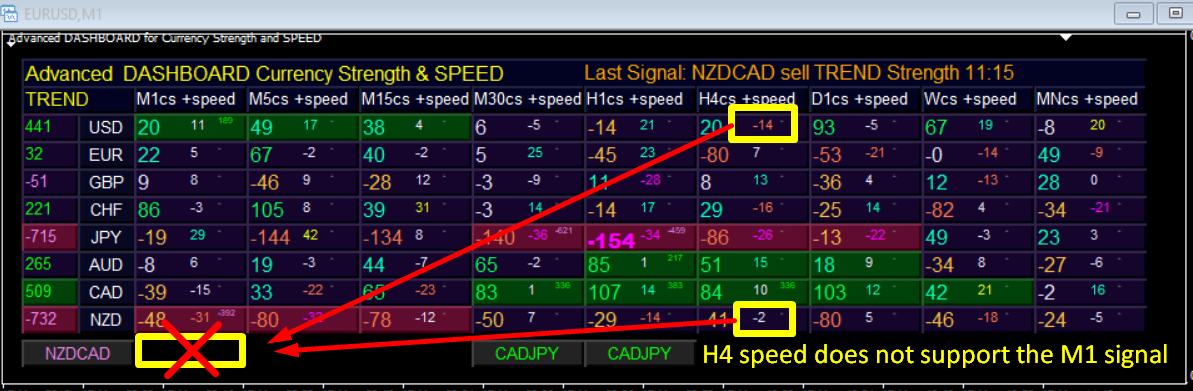

It also allows you to add different custom indicators and EAs you might benefit from. Source: How to trade forex using currency strength MetaTrader 4 Supreme Edition — Forex Strength Meter — Correlation Matrix. The chart above shows a Forex strength meter in the form of a unique correlation matrix. The strength of each of the major currencies is indicated by colours as we noted in the above paragraph.

The currencies are also listed by different colours. This allows you to see at a glance how strong or weak different currencies are. In the Forex market, currency units are quoted as currency pairs. The base currency — also called the transaction currency — is the first currency how to trade forex using currency strength appears in a currency pair quotation, followed by the second part of the quotation called the quote currency or the counter currency.

The example above shows that CAD is the strongest currency, how to trade forex using currency strength, as it shows a 91 correlation between USDCAD and EURCAD CAD is the quote currency.

The weakest correlation is between EURGBP GBP is the quote currency and GBPCHF GBP is the base currency — — which means that the simultaneous positions in this pair within the same direction are very likely to cancel each other out, indicating GBP strength and that the Swiss Franc is the weakest currency.

Some currency meters may also provide trading signals, alongside Forex currency strength. The example above combines currency strength with a momentum-style measurement to indicate buy and sell signals for a wide number of pairs. This allows you to identify which pair has the potential to move in a certain direction.

Did you know that Myfxrate offers an enhanced version of Metatrader that boosts trading capabilities? Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget — which allows you to buy or sell via a small window while you continue with everything else you need to do.

It takes into account both the base and quote currencies. Here is how the correlations can be observed, according the colours achieved:. The calculation method may vary according to which Forex meter you use. One of the best known measures of a currency in isolation is the aforementioned base vs quote currency concept.

This gauge calculates the value of all available currencies relative to each other. A lesser known, but more comprehensive measure is the broad USD index, which uses a wider selection of currencies.

Both work in a similar way. They calculate the strength of the Dollar by aggregating bilateral exchange rates into a single number, and then applying a weighting for the currencies included. The weighting applied for the broad index is a trade weighting, derived from trade how to trade forex using currency strength. Specifically, this is the share of merchandise imports in annual bilateral trade with the U. They use how to trade forex using currency strength exchange rates of different currency pairs to produce an aggregate, comparable strength of each currency.

Simple meters may not use any weighting, while more advanced ones may apply their own weightings. They may even combine other indicators with the currency strength measurement, to provide trading signals.

In terms of the Myfxrate Correlation Matrix — the true strength currency meter uses complex algorithms, but is very easy to use. It even allows you to choose a strength for a certain period of time. For intraday trading, it is typically recommended to use up to bars, while for scalping, up to 50 bars should be enough. Professional traders typically use an FX strength meter as a short-term indicator. A major advantage of the Forex strength meter is how simple it is to understand. This is especially appealing to the novice trader.

The Forex money grid meter is possibly among the very best free money asset indexes outthere! There are flaws too. The index simply conveys an extremely narrow bit of information. Is it true that the money meter right tell how to trade forex using currency strength narrative such as other indicators?

Will the trend last? You may come across the usefulness of a money strength meter constraints it self. By way of instance, you may desire to make use of a strength meter to match or confirm what additional signs are all saying. The image above displays the GBPJPY graph, with a Relative Strength Index RSI index implemented.

The RSI tries to spot once a musical device is over sold or under sold. The methodology supporting conventional indicators is wellknown, however, the calculations taken for custom durability meters away from unknown sources has been obscure. Stilla Forex strength meter could supply a convenient guide of just how each money is faring, in addition to additional advice for dealing together with indicators that are more in-depth. Prior to Making any investment decisions, you should seek guidance from independent financial advisors to ensure You Realize that the risks.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Toggle navigation. The Difference Between Your Currency Strength Meter as well as also the Correlation Matrix There are a number of difficulties with badly publicized currency strength meters. Forex Correlation Matrix — The Real Currency Strength Meter Over the years, the Forex strength meter has naturally evolved into a correlation matrix that could also be more complex and accurate.

The Advantages of Using the Real Currency Strength Meter Elimination of Double Exposure Opening multiple positions with pairs that are highly correlated is not advisable, as it gives rise to more exposure. Elimination of Unnecessary Hedging If the correlation strength between different pairs is known in advance, how to trade forex using currency strength, a trader can avoid unnecessary hedging.

Signal High Risk Trades Correlation between different how to trade forex using currency strength pairs can also signal the amount of trade strategy risk. Positive and Negative Correlation Signals True Currency Strength Source: Myfxrate MetaTrader 4 Supreme Edition — Correlation Matrix In the example above, positively correlated pairs have shown positive correlation between them, therefore, they move in a similar direction. MetaTrader Supreme Edition — Myfxrate Did you know that Myfxrate offers an enhanced version of Metatrader that boosts trading capabilities?

Download it for FREE today by clicking the banner below! How Does the Forex Currency Strength Meter Work?

How To Use The Currency Strength Indicator Properly!

, time: 14:59How to Trade Using a Forex Currency Strength Meter - My FX Rate

10/21/ · 3 Things Currency traders need to do now: 1. Leave a Comment letting us know how you can use currency strength for trading success. 2. Make sure to access the free tool and bookmark the link so you can use it all the time. 3. Consider Downloading our POWER STRATEGY REPORT and Let us know what you think of it! Thank you for reading!Estimated Reading Time: 7 mins 7/29/ · Forex strength meter. The Forex strength meter is a tool that measures the strength of individual currencies in a pair. This indicator goes further in employing Moving Averages and ADX indicators to confirm the strength of a pair, identify the trend and identify the stage of the trend. The MT4 indicator takes the readings from every forex pair over 8/28/ · When using a Forex currency strength index, currencies are evaluated by both their closing price and the highest price reached during the session. If a pair is above its prior bar’s high, this is considered very bullish. If a pair is above its prior bar’s close but below the high, this is Estimated Reading Time: 8 mins

No comments:

Post a Comment