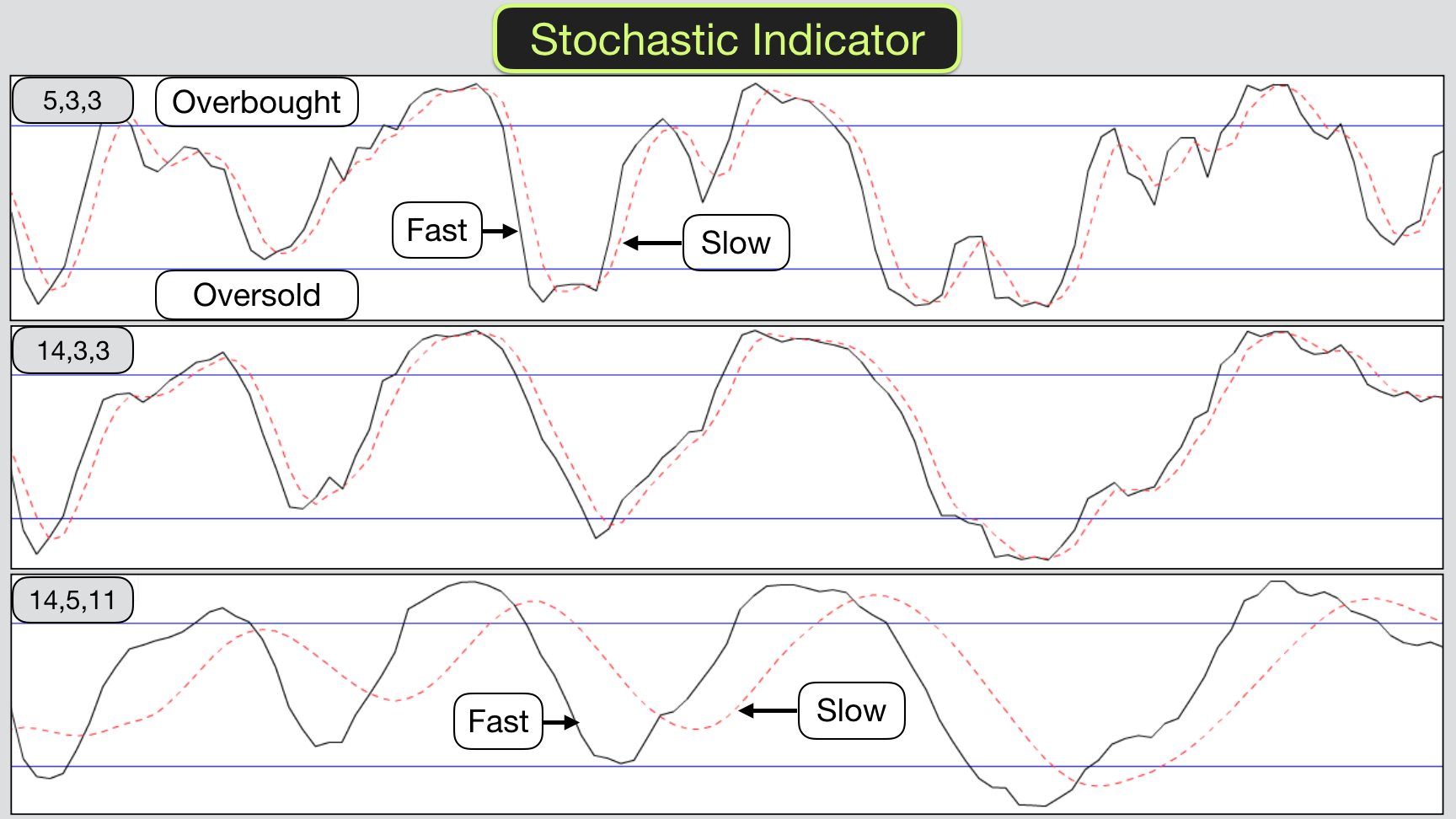

4/21/ · Use candlestick charts for hourly charts. Look for bullish or bearish pattern formation as we saw the Top formation in previous example. Stochastic settings for Day Trading: %K Period – 20 %K Slow – 3 %D Period – 3. These settings work best for me. You can also try these settings. they should work best for you blogger.comted Reading Time: 7 mins 9/16/ · Stochastic Oscillator Settings for Forex Trading. Stochastic Oscillator Settings is 5, 3, 3 by default on MT4 platform. It seems that is the best settings for this indicator. However, some Forex traders like to try the faster and slower settings. The larger the numbers, the slower the indicator, and visa versa The Stochastic Forex Scalping Trading Strategy will allow Forex traders to make incremental profits over short time frames. Over time, these small profits can add up to substantial amounts and can prove to be very lucrative for forex traders. For this particular trading strategy, the timeframe that should be used is the minute chart

Stochastic Oscillator Settings for Forex Trading

Stochastic Oscillator is an indicator that is widely used by the professional trader to understand market volatility. It best stochastic settings for forex the most well-known indicator used for indices, forex, stock trading.

Most of the professional trader trades with the default parameters by combining other indicators to find high accuracy trades, best stochastic settings for forex. In the s, Dr. Gorge Lane invented the Stochastic Oscillator indicator. It invented to find buying and selling pressure of the market.

It can also identify the cycle rotation that spare power within bulls and bears. Many traders take benefit of this reliable indicator. Stochastic Oscillator is a momentum indicator. It ranges between and o by default. It shows the location of the close relative to the high-low range on a set number of parameters. Below is the default setting of the Stochastic Oscillator looks on the Meta Trader trading platform:.

When the Stochastic reading is above 80 levels indicating the market is overbought. And below 20 indicates the market is oversold. Usually, the market gives sell signals when Stochastic lines are above 80 and return to below In contrast, the market gives a buy signal when Stochastic lines are below 20 and return to above Moreover, when the security price is near the top or bottom level, the Stochastic signals of Overbought and oversold by residing inside the range of the specific time frame.

Divergence happens when the asset price makes a new high or low without showing on Stochastic Oscillator. As an example, the price goes to a new high. It is called bearish divergence. Bearish Divergence can signal a forthcoming market shift from a bullish trend to a bearish trend.

Bullish Divergence suggests a probable upcoming market switch to the upside, best stochastic settings for forex. For example, Stochastic Oscillator is giving a divergence signal. But the price may go upward for a few amounts of trading session and after that turn to downward.

Gorge Lane advised, to wait for some confirmation of the market shift before entering any trade. At which point the fast Stochastic line and the slow Stochastic line intersect that impose to crossover. The best stochastic settings for forex disadvantage of the Stochastic Oscillator is the tendency of giving wrong signals. Particularly during stubborn and highly volatile trading situations.

Always keep in mind that Stochastic Oscillator invented mainly to measure power and weakness, not the trend. The more knowledge you have with the indicator, it will enhance your sustaining of probable signals. Some professional traders choose the low setting for short-term trading or scalping. Some traders choose high setting for long-term trading. Because a highly smoothed outcome only responds to the key changes in the price action. NZDUSD show different Stochastic Oscillator parameters rely on variants.

After reaching the overbought and the oversold level, the fast line intersects the slow line then Cycle turns over. Moreover, the 5, 3, 3 parameters turn over buy and sell cycles repeatedly without reaching the overbought and oversold level. Besides, the 21, 7, 7 parameters work based on a longer period.

But keep easing at a comparatively low level, and gives fewer buy and sell signals. Furthermore, the 21, 14, 14 parameters work on a giant dataset, rarely gives signals, and mostly near the key level. While the deepest turns expected at the overbought and oversold levels, and crosses within the middle of the panel may rely on, then renowned support or resistance levels line up.

NZDUSD climb above the day EMA after volatility decreased and created new support 1. It is forcing the Stochastic line to turn higher before reaching the oversold level. Also, it broke above the falling trend line and pulled back 2 triggering a bullish crossover at the middle point of the panel. Besides, the bullish rally reversed back to find support at the day EMA 3while best stochastic settings for forex a third bullish move above the oversold level, best stochastic settings for forex.

Different traders have a different mindset about using Stochastic. Some of them use the default setting only. And some of them use it by combining with the other indicators like — RSI, MACD, MA, best stochastic settings for forex, EMA etc.

You have to find what Stochastic Oscillator settings suit your psychology and trading style. Publish on AtoZ Markets. Get Free Trading Signals Your capital is at risk. close ×.

Stochastic Indicator Secrets: Trading Strategies To Profit In Bull \u0026 Bear Markets

, time: 11:19Best Stochastic Settings For Swing Trading-TradingTechnicals

6/17/ · 80 and 20 are the most common levels used, but can also be modified as required. For OB/OS signals, the Stochastic setting of 14,3,3 works well. The higher the time frame the better, but usually a H4 or a Daily chart is the optimum for day traders and swing blogger.comted Reading Time: 9 mins The Stochastic Forex Scalping Trading Strategy will allow Forex traders to make incremental profits over short time frames. Over time, these small profits can add up to substantial amounts and can prove to be very lucrative for forex traders. For this particular trading strategy, the timeframe that should be used is the minute chart 4/13/ · as far as forex slow stochastic goes, i like my setting at ,3,3 and my macd at ,22,9 here is the reason: what exactly are they mesuring? overbought/over sold on stoch and moving averages cross over with macd measureing divergence and momentum

No comments:

Post a Comment