Feb 04, · Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a Estimated Reading Time: 5 mins A short position is the exact opposite of a long position. The investor hopes for, and benefits from, a drop in the price of the security. Executing or entering a short position is a bit more complicated than purchasing the asset. In the case of a short stock position, While long and short in financial matters can refer to several things, in this context, rather than a reference to length, long positions and short positions are a reference to what an investor

Long Trades vs. Short Trades: Which Should I Use?

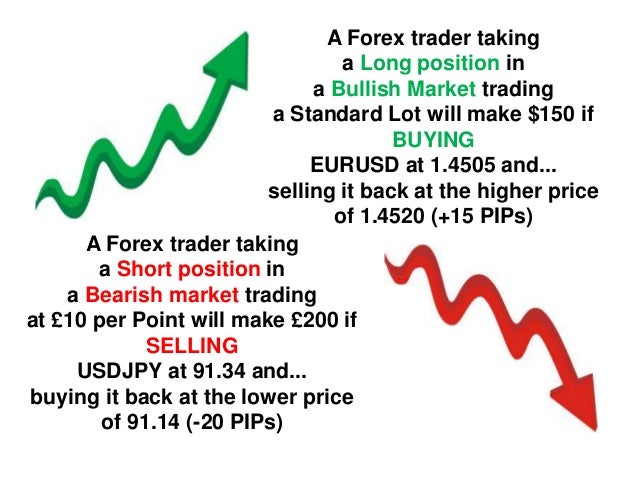

Day traders on the stock market have their explain long and short in forex language. You're learning, but some of the terms take time to understand and use right. If you're unsure about the terms "long" vs. Many new traders get confused by these two words. You initiate a long trade when you buy an asset with the expectation to sell it at a higher price in the future and make a profit.

A short trade is initiated by borrowing an asset to sell it, with the intent to repurchase it at a lower price, take a profit, and return the shares to the owner. When a day trader is in a long tradethey have purchased an asset and are waiting to sell when the price goes up. Day explain long and short in forex often use the terms "buy" and "long" interchangeably, explain long and short in forex.

Similarly, some trading software has a trade entry button marked "buy," while others have buttons marked "long, explain long and short in forex. and want to sell them at a higher price. You might hear a trader say they are "going long" or "go long" to indicate interest in buying a particular asset. This is what you're hoping for by going long. When you go long, your profit potential is unlimited. This means that the price of the asset could rise indefinitely.

You'll be more likely to see long positions measured in cents rather than dollars. The flip side to an increase in price is a decrease. Day traders work to keep risk and profits under tight control using options called a stop loss, a long calland a long put. These options let you profit from multiple small moves and avoid large price drops. You buy a long call to have the right to buy a stock make another trader sell it to you at a specific price; you buy a long put to have the right to sell the stock make another trader buy it from you at a specific price.

The stop loss is an order placed to keep from losing too much on a trade if the price moves against you. Shorting a stock is confusing to most new traders. In the real world, you have to own something to sell it.

You can enter short trades sell assets before buying them in the hopes that the price will go down so that you can explain long and short in forex it to another trader. You'll hear traders use the terms "sell" and "short" to refer to the same action. Some trading software has a trade entry button marked "sell," while others have one labeled "short. When you short a stock, your profit potential is limited to the amount you paid, but the risk becomes unlimited because the price could rise indefinitely, explain long and short in forex.

Your account will show that you have negative 1, shares, which will need to be replaced, explain long and short in forex. You can buy options to help you mitigate losses when you're short. The stop loss is the same, but these options are used when you're short—a stop loss, a short call, and a short put. You buy a short call to have the right to sell a stock make another trader explain long and short in forex it at a specific price; you buy a short put to have the right to repurchase a stock make another trader sell it to you at a specific price.

The stop loss prevents you from losing too much on a trade if the price moves against you. Shorting, or selling short, allows you to profit if the market is moving up or down.

You can sell and buy throughout the day on price movements, which is why many traders only care that the prices are moving, not which direction they are moving. Shorting stocks is popular with professional traders. While it is a good tactic for making a profit, it tends to drive stock prices to drop too quickly when done on a large scale.

The SEC has also issued warnings about shorting stocks or even just buying and selling them based on what you may hear on social media, news outlets, or websites to keep you and other retail investors from being used to manipulate the market. You would go long or use a long trade on a stock that you believe or know will rise in price.

A long trade to a day trader is at most one trading day, explain long and short in forex. If you find an opportunity to enter a trade, and you know the stock price will increase and be desirable for another trader after you buy ityou'd go long on that stock. You would go short on a trade if you know the price was going to decline.

Your broker must borrow the shares from the owner probably another broker or lend them to you if they own them, explain long and short in forex. If the broker can't borrow the shares for you, you're not going to be able to short the stock. Stocks that just started trading on the exchange—called Initial Public Offering stocks IPOs —are not shortable able to be sold and then bought. Traders can go short in most financial markets. A trader can always go short in the futures and forex markets different from the stock market.

Most stocks are shortable in the stock market as well, but not all of them. Whether you go long or short depends on the amount of risk you can take on and your trading strategy and preferences. There might be times when you're long on one stock and short on another.

You might even find an occasion to short a stock, then go long on it. Some traders can keep shorting the same stock throughout a trading day.

When you're trading stocks, a long position is one where you buy a stock and try to sell it at a higher price. You can think of explain long and short in forex as holding a stock for a long time, even though it might only be a few minutes. A short is when you borrow and sell a stock or stocks. Think of it as being short that number of stocks and needing to repurchase them. Which one you use depends on the specific stock and the price action when you are trading. They are both excellent strategies for turning a large number of small profits over time, but they both have their limitations.

If you're long, you have to buy the stock and the options and then hope for a price increase. If you're short, you owe your broker several stocks no matter what the price ends at, explain long and short in forex.

Using trade options can help you mitigate your losses for both long and short positions—just ensure that you don't risk more than you can afford to lose and stick to your entry and exit strategies. Securities and Exchange Commission. Accessed June 5, Trading Day Trading. Part of. An Introduction to Day Trading Overview Day Trading Basics. Day Trading Instruments. Placing Orders. Trading Psychology. By Full Bio. Adam Milton is a former contributor to The Balance.

He is a professional financial trader in a variety of European, U. Read The Balance's editorial policies.

Reviewed by. Full Bio. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Article Reviewed on June 01, Read The Balance's Financial Review Board. Key Takeaways In day trading, "long" and "short" trades refer to whether a trade was initiated with a purchase or a sale. In a long trade, you purchase an asset and wait to sell when the price goes up.

When you're in a short trade, you borrow an asset, sell it, and hope to buy it back when the price goes down. Long Trade Short Trade Entry Action You buy the asset You borrow an asset and sell it Wait You hold the asset to sell higher than the purchase price You wait for a lower price on the asset Exit Action You sell the asset and make a profit You buy the asset back at a lower price, make a profit, and give it back to the lender.

Article Sources. Part Of.

LONG AND SHORT TRADES IN FOREX

, time: 7:39“Long” and “Short” Trades Explained

Sep 24, · Going short in the forex market follows the same general principle—you're betting that a currency will fall in value, and if it does, you make money—but it's a bit more complicated. That's because currencies are always paired: Every forex transaction involves a short position in one currency and a long position (a bet that the value will Estimated Reading Time: 4 mins While long and short in financial matters can refer to several things, in this context, rather than a reference to length, long positions and short positions are a reference to what an investor Calculate your Position Size and Account Balance. 1. Create a Long Position or Short Position drawing. 2. In properties dialog of the instrument enter your initial account size and risk amount (either in absolute numbers or as a % of your account size). You can also enter the Lot Size

No comments:

Post a Comment