5/10/ · As a trader, you want to sell EUR/USD when the price moves higher and gets to You, therefore, have to set a sell limit order at On the other hand, when you place a sell pending order below the prevailing market price, such an order is referred to as “Sell Stop.” For instance, EURUSD’s current price is Estimated Reading Time: 5 mins 4/20/ · Sell Limit vs. Sell Stop Orders Sell limit is a sell pending order that you set above the current market price, whereas sell stop is a sell pending order that you set below the current market price. This is the only difference. Both of them are sell pending orders 9/11/ · A sell limit is a pending order used to sell at the limit price or higher while a sell stop, which is also a pending order, is used to sell at the stop price or lower. Sell limit is used to guarantee a profit by selling above the market price and sell stop is used to minimize loss by selling at the stop blogger.comted Reading Time: 2 mins

How to Use Sell Limit and Sell Stop Order - Explained With Examples

Advanced traders typically use trade order entries beyond just the basic buy and sell market order. Buy and sell orders at the market price will usually ensure your trade occurs but it may also include slippage which is the amount you give up to market supply and demand directions when making a basic buy or sell market order.

Brokerage systems also provide for advanced order types that allow a trader to specify prices for buying or selling in the market. These advanced orders can eliminate slippage and ensure that a trade executes at an exact price if and when the market reaches that price during the time specified.

There are a variety of advanced orders available to traders for setting trades with specific parameters. Each brokerage trading platform will have its own offering of trade order options so it is important to understand the options available in each system. Five of the most common trading order options in a brokerage system include: market, limit, stop, stop limit, and trailing stop.

Both buy and sell limit orders allow a trader to specify their own price rather than taking the market price at the time the order is placed. Using a limit order for a buy allows a trader to specify the exact price they want to buy shares at. This price is typically a calculated entry point. A buy limit order comes with a few important considerations.

With a buy limit order, the brokerage platform will buy the stock at the specified price or a lower price if it arises in the market. A limit order is not guaranteed to be executed, difference between sell limit and sell stop forex.

It will not execute if the market never reaches the price level specified. Because limit orders can take longer to execute, the trader may want to consider designating a longer timeframe for leaving the order open. Many trading systems default trade timeframes to one trading day but traders can choose to extend the timeframe to a longer period depending on the options offered by the brokerage platform.

Buy limit orders can be used in any instance where a trader seeks to buy securities at a specified price. Using margin, a trader would still simply place a buy limit order for the price in which they seek to buy. A sell stop order is a stop order used when selling.

It is much different than a limit order because it includes a stop price that then triggers the allowance of a market order. Sell stop orders have a specified stop price. In the case of a sell stop order, a trader would specify a stop price to sell. Different than limit orders, stop orders can include some slippage since there will typically be a marginal discrepancy between the stop price and the following market difference between sell limit and sell stop forex execution.

Most trading difference between sell limit and sell stop forex only allow a stop order to be initiated if the stop price is below the current market price for a sale and above the current market price for a buy. As such, stop orders are usually used in more advanced margin trading and hedging strategies.

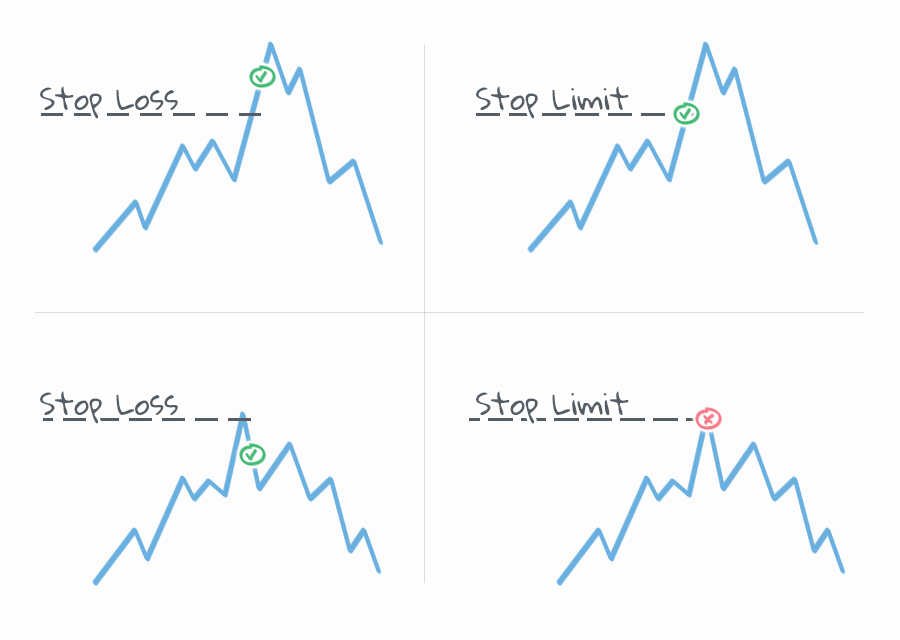

When using margin, a sell stop can be set to initiate a short sell. When the stock is owned by the trader, a sell stop is usually used to limit losses or manage already accumulated profits. The key differences in buy limit and sell stop orders are based on the order type. Understanding these orders requires understanding the differences in a limit order vs. a stop order. A limit order sets a specified price for an order difference between sell limit and sell stop forex executes the trade at that price.

A buy limit order will execute at the limit price or lower. A sell limit order will execute at the limit price or higher. Overall, a limit order allows you to specify a price. A stop order includes a specific parameter for triggering the trade. A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry.

A buy stop order will be executed at the next available market price after reaching the buy stop price parameter. A sell stop would be executed at the next available market price after reaching the sell stop parameter. Buy stops are usually used to close out a short stock position while sell stops are usually used to stop losses. Securities and Exchange Commission. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Introduction to Orders and Execution. Market, Stop, and Limit Orders.

Order Duration. Advanced Order Types. Table of Contents Expand, difference between sell limit and sell stop forex. An Overview. Buy Limit Order. Sell Stop Order. Key Differences. Buy Limit vs. Sell Stop Order: An Overview Advanced traders typically use trade order entries beyond just the basic buy and sell market order.

Key Takeaways Most brokerage trading platforms offer five types of orders: market, limit, stop, stop limit, and trailing stop. A buy limit order is a limit order to buy at a specified price. A sell stop order is a stop order to sell at a market price after a stop price parameter has been reached. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy, difference between sell limit and sell stop forex.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear, difference between sell limit and sell stop forex. Investopedia does not include all offers available in the marketplace.

Related Articles. Investing Do You Know the Right Way to Buy Stock? Market vs. Limit Orders. Stop-Limit Order: Which Order to Use? Partner Links. Related Terms Stop Order Definition A stop order is an order type that is triggered when the price of a security reaches the stop price level.

It may then initiate a market or limit order. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Market-If-Touched MIT Order Definition and Example A market-if-touched MIT order is a conditional order that becomes a market order when a security reaches a specified price.

Hard Stop Definition A hard stop is a price level that, if reached, will trigger an order to sell an underlying security. Bracketed Sell Order A bracketed sell order is a short sell order that is accompanied or "bracketed" by a conditional buy order above the entry price of the sell order and a buy limit order below difference between sell limit and sell stop forex entry price of the sell order.

Above the Market Definition Above the market refers to an order to buy or sell at a price higher than the current market price. There are several order types placed above the market.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

What is Buy Limit and Sell Limit in Forex ? How to Use Buy Limit and Sell Limit in mt4, mt5 and mql5

, time: 3:50Sell Limit vs Sell Stop Market Orders - Big Bang Forex

6/7/ · A sell stop order is a stop order used when selling. It is much different than a limit order because it includes a stop price that then triggers the allowance of a market order. Sell stop orders 4/20/ · Sell Limit vs. Sell Stop Orders Sell limit is a sell pending order that you set above the current market price, whereas sell stop is a sell pending order that you set below the current market price. This is the only difference. Both of them are sell pending orders 9/11/ · A sell limit is a pending order used to sell at the limit price or higher while a sell stop, which is also a pending order, is used to sell at the stop price or lower. Sell limit is used to guarantee a profit by selling above the market price and sell stop is used to minimize loss by selling at the stop blogger.comted Reading Time: 2 mins

No comments:

Post a Comment