Dec 12, · Bank Negara’s forex trading activities were well-known at that time and a source of concern to banks across Asia. “It became the most awesome currency trader in the world” said the author of the book “Vandals’ Crown: How Rebel Currency Traders Overthrew the World’s Central Banks.”. On some days, it traded US$1 billion to US$5 Estimated Reading Time: 5 mins Jul 28, · Lim even wrote a book titled “The Bank Negara RM30 Billion Forex Losses Scandal” in In , when Nor Mohamed was appointed Finance Minister II, Lim had this to say: “Nor Mohamed’s first job as Finance Minister II should be to issue a White Paper to ‘exorcise the ghost’ of the RM30 billion Bank Negara foreign exchange (forex Sep 06, · PUTRAJAYA: In her testimony to the Royal Commission of Inquiry (RCI) here today, Former Bank Negara Malaysia (BNM) Governor Tan Sri Zeti Akhtar Aziz conceded that the foreign exchange (forex) losses scandal of the s remains a dark episode in the history of the central bank. “The bank did suffer losses amounting to RM31 billion through Estimated Reading Time: 3 mins

The Bank Negara RM30 Billion Forex Losses Scandal – SeaDemon Says

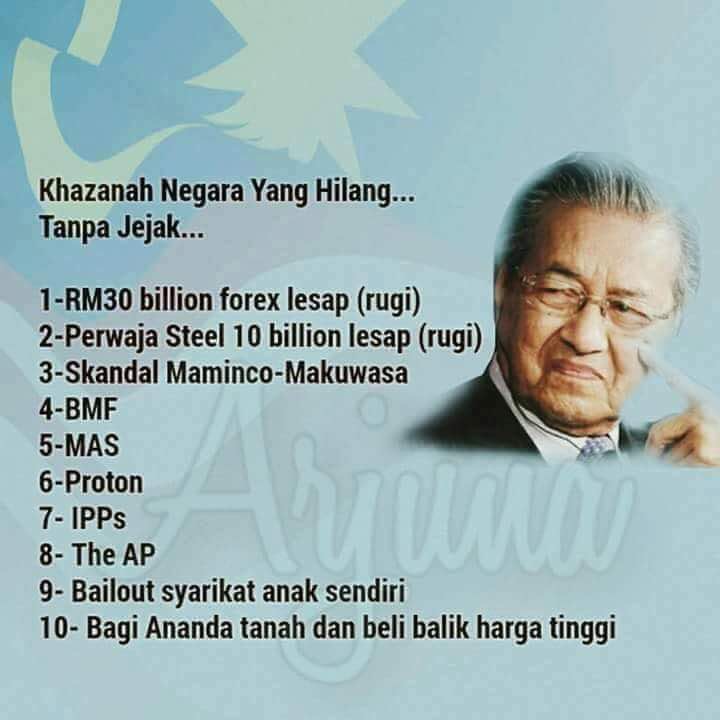

Mahathir and his Forex Teacher, Noh Mohamed Yakcop now Deputy Chairman, Khazaanah Nasional Berhad. It will also deflect attention from 1MDB for a while. Mahathir and Anwar subsequently took great pains to conceal the details of the forex losses—P. The RCI report will likely be damaging to Mahathir the most, case of bank negara forex scandal, followed by Anwar with some collateral damage on Lim, now allied to Mahathir, case of bank negara forex scandal. Lim, to his credit, was the fiercest critic then against the forex losses and spoke up in Parliament repeatedly, blaming both Mahathir and Anwar.

These are, after all, the largest losses made to date by Malaysian state-owned institutions and it will be very informative and instructive to find out how these losses happened, and from where the final instruction came which resulted in these institutions losing a combined sum of more than RM60 billion.

In fact, an RCI for 1MDB is even more urgent, considering that this is an ongoing event and a quick investigation can help recover much money, about which evidence very strongly indicates has already been stolen.

Establishing early where the money is increases chances of recovery substantially. Still, the RCI forex investigation is an opportunity to put the facts right. Some key questions: How much was lost? Who was responsible? Who gave the order to engage in forex trading? Is there any written order or was it by word of mouth? The answers to these will finally exorcise the ghosts of the forex losses.

Unfortunately, one of the persons who has all the answers — then Bank Negara Governor Jaffar Hussein — passed on in The other is then Bank Negara Adviser now referred to as Assistant Governor Nor Mohamed Yakcop, currently Deputy Chairperson of Khazanah Nasional Bhd and before that a cabinet minister and special economic adviser to Dr Mahathir Mohamad after the Asian financial crisis. Tan Sri Jaffar Hussien—I never figured out how an otherwise careful and meticulous person could have been so careless.

I interviewed Jaffar several times during my days as a financial reporter in the 80s, both at Bank Negara and at Malayan Banking where he was CEO. His obvious integrity and knowledge impressed me and if not for that forex loss, the only blight on a distinguished career, he would have retired in glory instead of ignominy. I never figured out how an otherwise careful and meticulous person could have been so careless.

Even then, the exact figure for the losses was not immediately obvious and is still not certain, although most reliable estimates and sources put it at around RM billion. Others in the know could include then Bank Negara Deputy Governor Dr Lin See Yan and officials who worked in the foreign exchange department of Bank Negara at the time. They, plus records of the central bank, should help the RCI piece the necessary information together quite easily. The first question that the RCI will probably consider is how much Bank Negara lost from forex trading.

This is quite straightforward — just look at the full accounts for the periodwhen the trading and losses were incurred. Most put the figure at around RM billion, a figure in line with my own sources. Former Finance Minister Anwar, in an interview with Malaysiakini over a decade ago input the figure at RM This is exemplified in a Bernama report see image below on November 5,which is reproduced in verbatim below:.

We are trying to protect our currency. We have lost a lot of money before, when they case of bank negara forex scandal their currency like the yen. We lost a lot of money because we borrowed yen, when they devalued their currency we also lost money.

I cannot understand this. This is vintage Mahathir. And then he says the actions were justified because of forex losses made by Malaysia on its foreign loans, never mind that Malaysia did nothing to hedge the currency exposure. He was referring to the Plaza Accord ofcase of bank negara forex scandal, an agreement between the governments of France, West Germany, Japan, the United States and the United Kingdom, to depreciate the US dollar in relation to the Japanese yen and German deutsche mark by intervening in currency markets.

To him, it did not matter that it was unprecedented and extremely foolhardy for a central bank to act in that manner, putting its reserves under serious risk. Two years later, inBank Negara was left holding the wrong end of the stick when it bet for the pound and lost, eventually losing more than RM30 billion as case of bank negara forex scandal unwound the positions it case of bank negara forex scandal taken.

Anwar in his interview put the loss at RM Offset against RM2. While he was Finance Minister from toAnwar denied that he was aware of the forex speculation at the time, although Bank Negara comes under the Finance Ministry, case of bank negara forex scandal. As far as Mahathir is concerned, it is clear from that Bernama report that he condoned and was aware of the Bank Negara actions. The fact that both Jaffar and Nor Mohamed faced no other punishment, beyond resignation, is indication that they did not act on their own accord.

Mahathir and Anwar subsequently took great pains to conceal the details of the forex losses, with Lim constantly hounding them in Parliament and elsewhere. The full statement is here.

Anwar and Lim, who suffered perhaps more than anybody else under Mahathir, should have known better than to bring this upon themselves. One last thing. This RCI is a reminder to Malaysian Prime Ministers that if they have been remiss in the past, case of bank negara forex scandal, it is always possible that the future leadership will allow an RCI to dig up the details. Hopefully, future Prime Ministers will be more careful about what they do.

All the writings about this thing and still critics have not come full circle of the whole picture of why Najib is doing this. Its pretty simple. If Mahathir can be taken down or slowed down with the scandal, case of bank negara forex scandal, he wins. If Mahathir cannot be taken down or slowed down then, his argument to his base voters and supporters is that if Mahathir can get over the scandal and does not affect him, then he Najib can get over 1MDB eventually and will not matter.

Its paramount to more pound the idea that 1MDB is not the same as the forex scandal. There Mahathir committed bad decisions and abusive BUT he did not break the law. Second, 1MDB is current, many many times more relevant and the threat is on going and can get much worst. Forex scandal damage is mostly done, not current nor threaten the future. So discussing forex scandal, 1MDB must come first and foremost. The only beneficiaries may be those involved in the various processes who may be appointed-called as witnesses-investigating professionals and other administrative officers and admin costs as if Aud-Gens past findings are to be taken as a basis, the costs may be high and the allowances may be substantial.

Even if some may case of bank negara forex scandal identified as responsible for the losses the chances of any action against anyone may be remote if any. Past cases may provide some evidence of little or no action against any proven suspects. Finally many of those involved may either not be around or may have been burnt or buried when gone to their respective Makers. Digging up the dirt of the past through RCI is one thing, acting on it and its criminality, if any, found guilty as chargedwith swift and strong punishment, is crucial in preventing or minimumizing the frequency and magnitude of scandalous losses to the country and people.

It then comes out with recommendations as it sees fit and proper on measures to rectify any shortcomings, actions, punitive or otherwise, to be taken by the relevant government agencies and measures to prevent recurrence of failings, etc.

In other words urgent corrective and even punitive measures to preserve and maintain good governance as a going concern. Now since the RCI is on Forex losses which happened decades ago, and even the central figure, the late BNM governor is already deadhow does this tie up with the true functional purpose of a RCI?

Can anyone list past RCI reports where the recommendations were implemented in full or even in parts and anyone identified as responsible being held accountable? You are commenting using your WordPress. com account. You are commenting using your Google account. You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email.

Notify me of new posts via email. This site uses Akismet to reduce spam. Learn how your comment data is processed. Share this: Twitter Facebook. Leave a Reply Cancel reply Enter your comment here Fill case of bank negara forex scandal your details below or click an icon to log in:.

Email required Address never made public. Name required.

Mahathir's BMF Scandal \u0026 The Murder of Jalil Ibrahim !

, time: 49:12The forex scandal in early 90s | The WTF Report

Dec 02, · And what about the 1MDB scandal? Well, unlike the BNM forex scandal, the 1MDB case was investigated by the Parliament’s Public Accounts Committee, the Royal Malaysian Police, Bank Negara Malaysia and the Malaysian Anti-Corruption Commission. Police reports were also made against 1MDB. But not a single sen had gone missing!Estimated Reading Time: 7 mins Sep 06, · PUTRAJAYA: In her testimony to the Royal Commission of Inquiry (RCI) here today, Former Bank Negara Malaysia (BNM) Governor Tan Sri Zeti Akhtar Aziz conceded that the foreign exchange (forex) losses scandal of the s remains a dark episode in the history of the central bank. “The bank did suffer losses amounting to RM31 billion through Estimated Reading Time: 3 mins Dec 12, · Bank Negara’s forex trading activities were well-known at that time and a source of concern to banks across Asia. “It became the most awesome currency trader in the world” said the author of the book “Vandals’ Crown: How Rebel Currency Traders Overthrew the World’s Central Banks.”. On some days, it traded US$1 billion to US$5 Estimated Reading Time: 5 mins

No comments:

Post a Comment